The Extensive Importance of Risk Management in Worldwide Supply Chains

The Extensive Importance of Risk Management in Worldwide Supply Chains

Blog Article

The Relevance of Recognizing the Significance of Risk Management in Various Industries

The Core Concept of Risk Management and Its Objective

Risk Management, the keystone of many markets, pivots on the recognition, examination, and mitigation of unpredictabilities in an organization environment. By properly determining prospective risks, businesses can establish methods to either stop these threats from happening or lessen their influence. Once risks have been recognized and assessed, the reduction procedure involves developing strategies to lower their prospective influence.

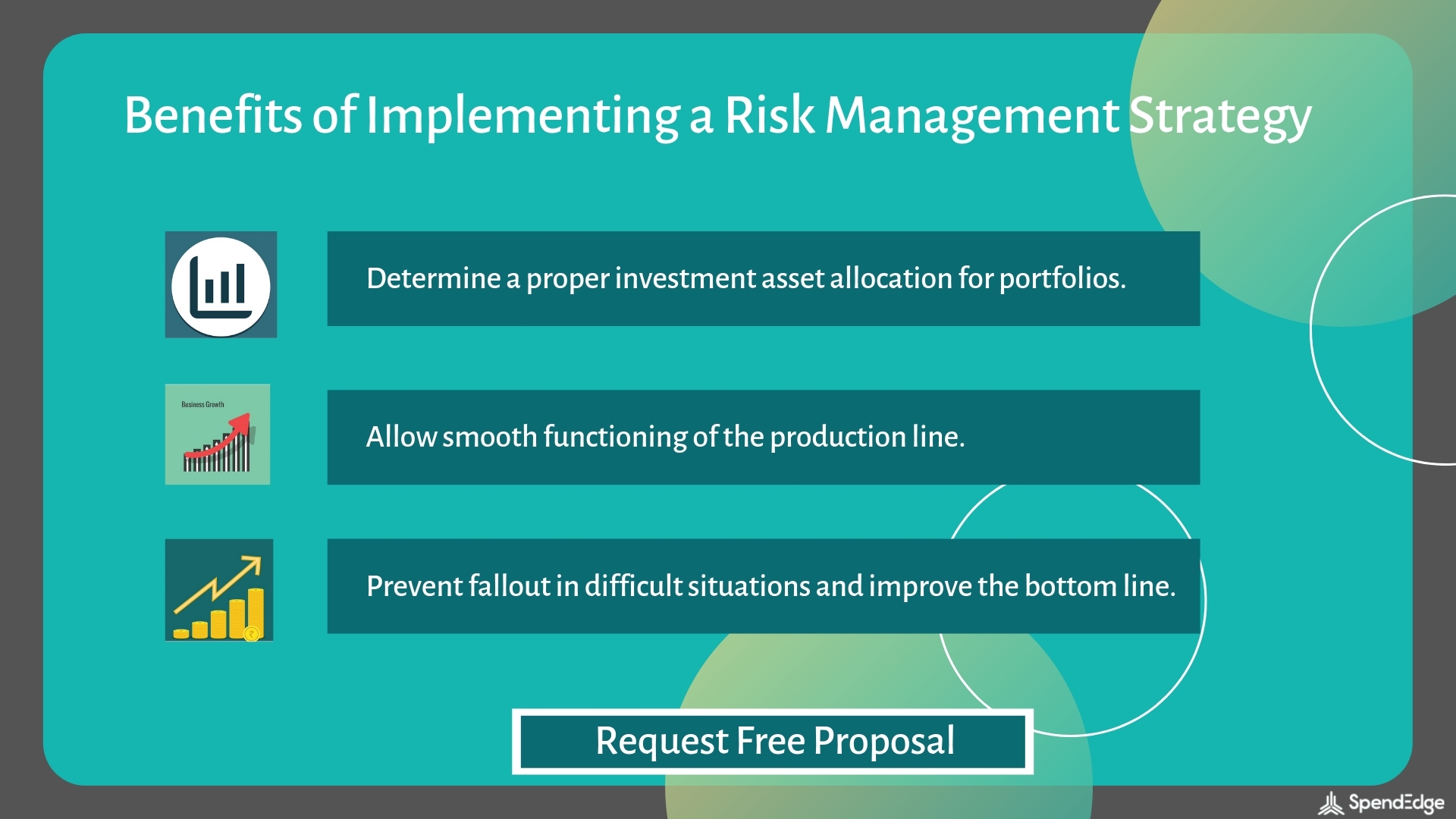

Advantages of Carrying Out Risk Management in Organization Procedures

:max_bytes(150000):strip_icc()/risk-management-4189908-FINAL-2-976ae194e01848618ca94941ab9d2395.jpg)

Introducing the Function of Risk Management in Different Industries

While every sector faces its distinct collection of dangers, the implementation of Risk Management strategies remains a common measure in their search of sustainability and development. In the health care field, Risk Management entails ensuring patient safety and data security, while in finance, it involves mitigating investment risks and ensuring governing conformity (importance of risk management). Construction business concentrate on employee safety and security, job hold-ups, and budget plan overruns. In the innovation sector, firms minimize cybersecurity hazards and modern technology obsolescence. Ultimately, the role of Risk Management across markets is to identify, evaluate, and alleviate risks. It is a vital component of calculated planning, making it possible for organizations to safeguard their assets, make the most of chances, and accomplish their goals.

Real-life Study Demonstrating Successful Risk Management

To recognize the relevance of Risk Management in these lots of why not find out more sectors, one can seek to a number of real-life circumstances that show the successful application of these actions. In the power industry, British Oil established Risk mitigation plans post the 2010 Gulf of Mexico oil spill. They implemented better security procedures and more stringent regulations which considerably lowered further mishaps. In a similar way, in finance, Goldman Sachs effectively browsed the 2008 economic situation by identifying potential mortgage-backed safeties threats early. Lastly, Toyota, upload the 2011 quake in Japan, modified its supply chain Management to lessen disturbance dangers. These situations show just how markets, gaining from crises, successfully used Risk Management methods to reduce future risks.

Future Trends and Advancements in Risk Management Methods

As the globe remains to advance, so too do the trends and growths in Risk Management strategies. Rapid advancements in innovation and data analytics are reshaping the Risk landscape. Huge information and AI are now crucial in read more predicting and mitigating risks. Organizations are leveraging these devices to construct predictive versions and make data-driven decisions. Cybersecurity, as soon as an outer concern, has actually catapulted to the center of Risk Management, with methods concentrating on avoidance, action, and discovery. The integration of ESG (Environmental, Social, Administration) factors into Risk Management is an additional expanding pattern, showing the raising recognition of the function that environmental and social dangers play in business sustainability. Thus, the future of Risk Management hinges on the fusion of innovative modern technology, cutting-edge strategies, and an all natural strategy.

Conclusion

In final thought, understanding the relevance of Risk Management across a spectrum of sectors is essential for their long life and success. Ultimately, successful Risk Management adds to a lot more sustainable and resistant businesses, highlighting the value of this technique in today's highly competitive and vibrant business setting.

While every industry faces its one-of-a-kind collection of threats, the implementation of Risk Management approaches continues to be a typical in their quest of sustainability and growth. In the healthcare sector, Risk Management entails ensuring person safety and security and information defense, while in finance, it involves mitigating investment dangers and guaranteeing regulative conformity. Ultimately, the function of Risk Management across industries is have a peek at these guys to identify, examine, and mitigate risks. These situations show just how markets, learning from situations, successfully used Risk Management techniques to reduce future threats.

Report this page